Apr 18, 2024 Joel Hernandez

Giving back through structured giving

Australia is a giving country, but we often give in kind rather than financially. Whenever there is a disaster here or overseas, Australians rush to donate their time, household goods and cash. However, we still lag New Zealand, the US, Canada and the United Kingdom when it comes to giving money.

According to Philanthropy Australia, our total financial giving as a percentage of Gross Domestic Product is just 0.81 per cent, compared with 0.96 per cent for the UK, 1 per cent for Canada, 1.84 per cent for New Zealand and 2.1 per cent for the US. Only 53 per cent of Australians with an income of more than $1 million give to charity and receive a tax deduction. In the United States that figure is 90 per cent. So, Australians have some catching up to do.

Currently the number of Australians making tax deductible contributions is at its lowest levels since the 1970s. Despite this, the Australian Tax Office reports that deductible donations claimed by individuals rose from $0.74 billion in 1999-2000 to $3.85 billion in 2019-20.

Given that an estimated $2.6 trillion will pass between generations over the next 20 years, the opportunities for increasing our financial giving abound. Philanthropy Australia wants to double structured giving from $2.5 billion in 2020 to $5 billion by 2030.

The five main reasons people like to give are that they:

- want to make a difference;

- want to give back to the community;

- like the personal satisfaction it gives them;

- have philosophical beliefs; or

- just want to set an example.

Structured giving

Donating large sums of money regularly is known as structured giving. You can choose a number of ways to establish a structured giving plan including through a public or private ancillary fund (PAF), a private testamentary charitable trust or giving circles. Giving circles are more prevalent in the US but they are growing in Australia. Basically, people with shared values come together to pool their money for a particular cause.

Whichever way you choose, there are attractive tax incentives to encourage the practice.

The giving arrangement you put in place will depend on:

- the timeframe of your giving

- the level of engagement you want

- whether you want to raise donations from the public

- whether you want to give in your lifetime or as a bequest

- whether you want to involve your family to create a family legacy.

Private Ancillary Funds

A private ancillary fund is a standalone charitable trust for business, families and individuals. It requires a corporate trustee and a specific investment strategy. Once you have donated, contributions are irrevocable, meaning they cannot be returned to the donor and are to be used for the stated purpose of the fund.

In order for your donation to be tax deductible, the cause you are supporting must be a body identified as a Deductible Gift Recipient (DGR) by the Australian Tax Office – essentially a tax deductible charity.

One of the benefits of a PAF is that you can make large tax deductible contributions which you can then allocate to a number of DGR charities over coming years. Some prefer to do this rather than to make large donations to select charities. In addition, the income of the fund is exempt from income tax.

You need to be able to make an initial contribution to a PAF in the vicinity of $500,000 in order to make it viable. This enables the earnings of the fund to cover the initial setup costs and the annual administration, investment, reporting, and audit costs. Ongoing costs can be in the vicinity of 1-2 per cent of the value of the fund

Each year you must distribute at least 5 per cent of the net value of the fund to your designated charities in order for the PAF to retain its tax free status.

Being in control of a PAF is a serious responsibility, but quite comfortably managed with appropriate professional help.

A similar arrangement is available through Public Ancillary Funds, which carry a lower level of responsibility for the individual, and for which the minimum initial contribution is generally around $20,000.

Testamentary Charitable Trust

An alternative to a PAF is a Testamentary Charitable Trust, which usually comes into being after the death of the founder. The governing document is either a trust deed or the founder’s Will.

With a Testamentary Charitable Trust, trustees control all the governance, compliance, investment and giving strategies of the trust. The assets of the trust are income tax exempt. The minimum initial contribution for such a fund is usually $500,000 to $2 million.

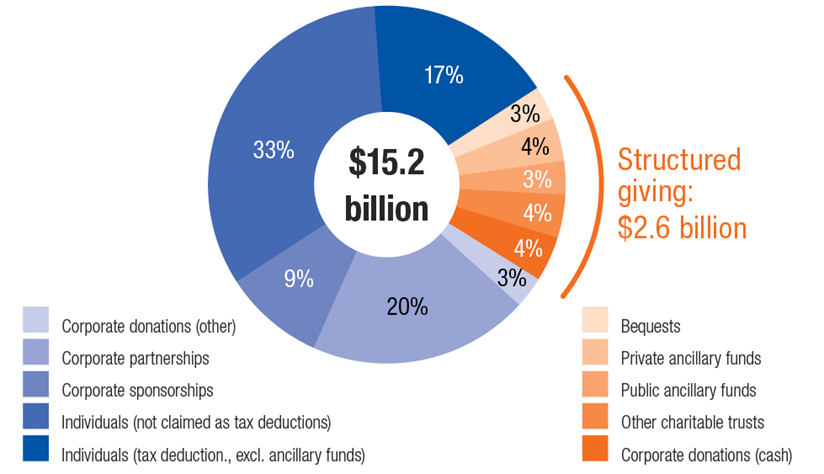

Philanthropy through structured giving still has a long way to go in Australia. In 2018-19, the total amount Australians gave to charitable causes was estimated to be $15.2 billion, of which $2.6 billion was structured giving, as the following graph shows:

If you want to know more about structured giving and what is the best vehicle for you then give us a call to discuss.