Feb 1, 2024 Matthew Hung

The Redesigned Stage 3 Personal Income Tax Cuts

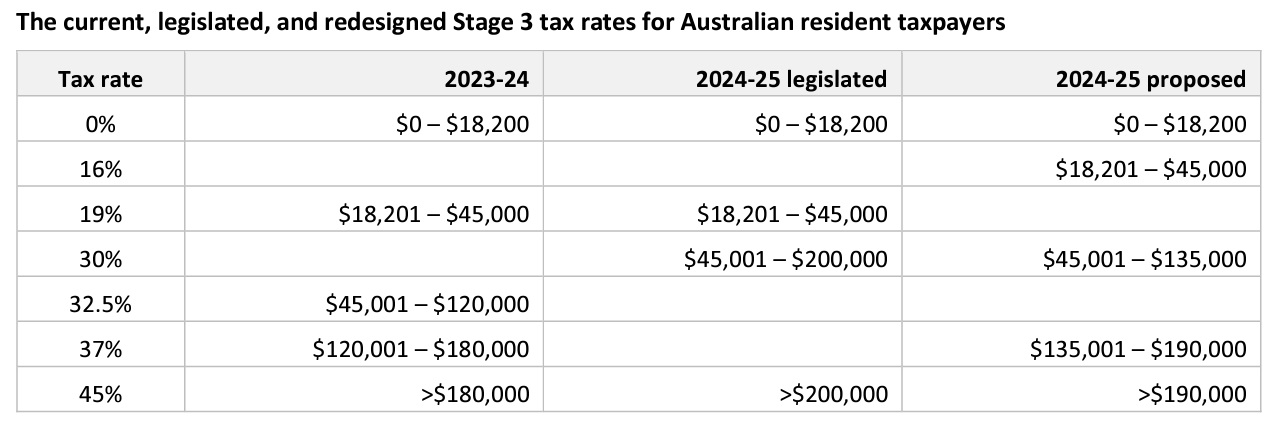

What will change ?

The revised tax cuts redistribute the reforms to benefit lower income households.

Under the proposed redesign, all resident taxpayers with taxable income under $146,486, who would actually have an income tax liability, will receive a larger tax cut compared with the existing Stage 3 plan. For example:

- An individual with taxable income of $40,000 will receive a tax cut of $654, in contrast to receiving no tax cut under the current Stage 3 plan (although they are likely to have benefited from the tax cuts at Stage 1 and Stage 2).

- An individual with taxable income of $100,000 would receive a tax cut of $2,179, which is $804 more than under the current Stage 3 plan.

However, an individual earning $200,000 will have the benefit of the Stage 3 plan slashed to around half of what was expected from $9,075 to $4,529. There is still a benefit compared with current tax rates, just not as much.

There is additional relief for low-income earners with the Medicare Levy low-income thresholds expected to increase by 7.1% in line with inflation. It is expected that an individual will not start paying the 2% Medicare Levy until their income reaches $32,500 (up from $26,000).

While the proposed redesign is intended to be broadly revenue neutral compared with the existing budgeted Stage 3 plan, it will cost around $1bn more over the next four years before bracket creep starts to diminish the gains.

It’s not a sure thing just yet!

The Government will need to quickly enact amending legislation to make the redesigned Stage 3 tax cuts a reality by 1 July 2024. This will involve garnering the support of the independents or minor parties to secure its passage through Parliament.